How Fortitude Financial Group can Save You Time, Stress, and Money.

Table of ContentsThe Facts About Fortitude Financial Group UncoveredFacts About Fortitude Financial Group RevealedWhat Does Fortitude Financial Group Do?Some Known Incorrect Statements About Fortitude Financial Group

With the best strategy in place, your money can go additionally to aid the organizations whose missions are lined up with your worths. A monetary advisor can help you define your charitable offering objectives and incorporate them into your monetary plan. They can likewise advise you in suitable methods to optimize your offering and tax obligation deductions.If your business is a partnership, you will certainly wish to go via the succession preparation procedure together - Financial Services in St. Petersburg, FL. A financial consultant can assist you and your companions comprehend the important components in company succession planning, identify the value of the business, develop investor contracts, develop a settlement framework for successors, synopsis change alternatives, and far more

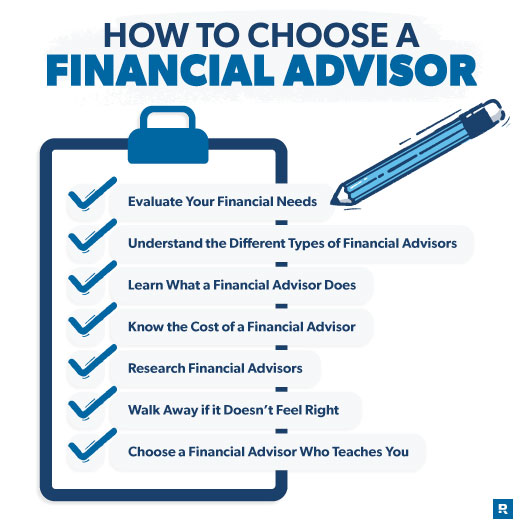

The secret is discovering the right financial advisor for your situation; you might wind up appealing different experts at various stages of your life. Try calling your economic establishment for recommendations. Content is for informational objectives just and is not planned to provide lawful or financial recommendations. The views and viewpoints shared do not always represent the views and viewpoints of WesBanco.

Your next step is to talk to a qualified, accredited specialist that can provide guidance tailored to your private conditions. Absolutely nothing in this article, nor in any type of connected sources, need to be construed as economic or legal guidance. While we have made great faith initiatives to ensure that the information offered was proper as of the day the web content was prepared, we are not able to assure that it remains exact today.

4 Simple Techniques For Fortitude Financial Group

:max_bytes(150000):strip_icc()/ways-financial-advisors-charge-fees-2388441_V1-b9356000e6194c3ebced21e583eb23f0.jpg)

Financial advisors help you make choices concerning what to do with your cash. Let's take a closer look at what precisely a monetary consultant does.

Advisors utilize their expertise and expertise to create tailored monetary strategies that intend to accomplish the monetary objectives of clients (https://www.easel.ly/browserEasel/14503343). These plans consist of not just investments however additionally financial savings, budget plan, insurance, and tax obligation techniques. Advisors better sign in with their clients on a normal basis to re-evaluate their present scenario and plan as necessary

Indicators on Fortitude Financial Group You Need To Know

To accomplish your objectives, you might require an experienced expert with the best licenses to help make these strategies a fact; this is where a financial advisor comes in. With each other, you and your expert will certainly cover lots of subjects, including the amount of cash you must save, the kinds of accounts you need, the kinds of insurance coverage you ought to have (including lasting care, term life, impairment, etc), and estate and tax obligation preparation.

Financial consultants offer a variety of solutions to customers, whether that's giving reliable general financial investment advice or assisting within an economic objective like buying a college education fund. Listed below, locate a checklist of one of the most typical services provided by financial advisors.: An economic expert uses suggestions on financial investments that fit your style, goals, and risk resistance, creating and adapting investing strategy as needed.: An economic consultant develops approaches to help you pay your financial obligation and avoid financial debt in the future.: An economic consultant offers suggestions and strategies to develop spending plans that aid you satisfy your objectives in the short and the long term.: Part of a budgeting method may consist of approaches that assist you spend for higher education.: Similarly, a financial expert creates a saving strategy crafted to your specific demands as you head into retirement. https://giphy.com/channel/fortitudefg1.: An economic consultant assists you recognize individuals or companies you intend to get your tradition after you pass away and produces a plan to execute your wishes.: A financial consultant gives you with the most effective lasting services and insurance alternatives that fit your budget.: When it concerns tax obligations, a financial expert may assist you prepare tax obligation returns, maximize tax obligation reductions so more info here you get the most out of the system, timetable tax-loss gathering safety sales, ensure the finest use the funding gains tax obligation prices, or plan to decrease tax obligations in retirement

On the questionnaire, you will also indicate future pension plans and earnings resources, task retired life requires, and define any type of long-lasting financial commitments. Basically, you'll note all present and expected investments, pensions, gifts, and incomes. The spending part of the questionnaire touches upon even more subjective subjects, such as your danger resistance and threat capability.

Fortitude Financial Group for Beginners

At this factor, you'll additionally allow your expert understand your financial investment choices too. The initial analysis might also include an assessment of other economic monitoring subjects, such as insurance coverage issues and your tax obligation circumstance. The expert requires to be aware of your existing estate strategy, in addition to other specialists on your planning team, such as accounting professionals and legal representatives.